RES Forecasting Model

It seems reasonable to assert that the recent surge in inflation is now in the past, though the possibility of a new inflationary shock cannot be entirely dismissed. Nevertheless, the trajectory of Gilt yields in the medium term remains uncertain, contingent on inflation indeed receding to (and perhaps falling below) 2% by 2025–2026.

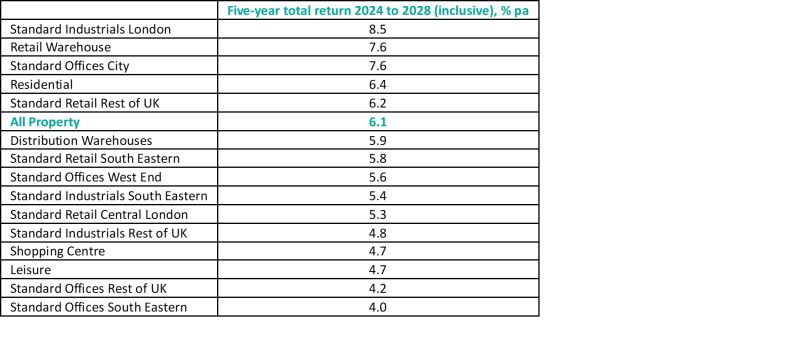

Our forecast for the total return over the five-year period from 2023 to 2028 anticipates an average of 6.1% per annum, with an income return of 5.3% per annum. In the hierarchy of rankings, London standard industrials claim the top position, surpassing retail warehouses. The office regions occupy the last two places in the ranking table.

The future is likely to more exciting than the forecast with two potential scenarios:

(1) Investors may be lured back into the market by the upward shift in property yields, the decline in gilt yields, and an overall strengthening economic environment.

(2) Alternatively, prices could experience further declines due to non-performing loans or distressed borrowers.

Currently, the first scenario appears to be the more plausible outcome, as the data indicates sporadic instances rather than widespread occurrences of non-performing loans. If neither alternative scenario unfolds however, and the main forecast scenario holds true, 2024 is expected to be a continuation of the current market malaise.