Thoughts on risk number 6: if the market was efficiently priced…

Return drivers can vary enormously across individual properties, e.g., rental growth or letting periods. As individual property variations can be diversified in a portfolio, market pricing should be based on the average expected outcome of the return drivers.

If the average outcome for one or more of these drivers is thought to vary between different groupings of property, then pricing should adjust to equalise the expected risk-adjusted return of each grouping. These property groupings are known as sectors or segments.

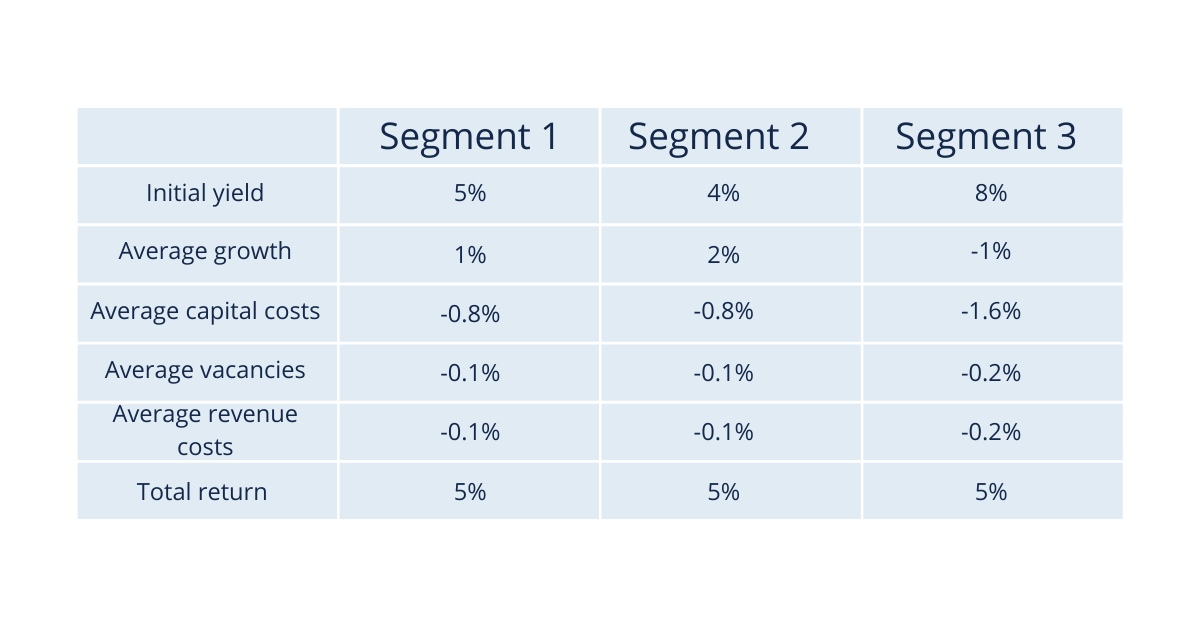

To illustrate, let’s assume that three segments have equal market risk, but that their expected average growth, capital costs, vacancies and irrecoverable costs vary between the segments. Assuming a required return of 5%, then the pricing across the three segments should adjust so that each segment is expected to deliver a 5% return.

At RES we look to identify segments that are not efficiently priced by modelling the long-term drivers of return (growth ,vacancies, costs) and the differential risks.

Table: illustrative adjustment of pricing to deliver an identical risk adjusted market return