RES Forecast, May 2024

I am pleased to share the latest insights from the May 2024 RES Forecasting Model, offering a comprehensive view of the UK real estate market across 64 categories. We’ve integrated MSCI quarterly data up to Q1 and the updated Oxford Economics forecast.

Key points:

* Forecast hinges on declining inflation, expected to drive Gilt yields to 3.1% by 2026, with modest economic growth by 2025.

* Despite improvements, household expenditure and financial & business service employment growth remain modest.

* MSCI Q1 2024 saw positive returns after two negative quarters, with industrial sectors leading.

* Total return forecast for 2024 at 5.2%, with 0.7% capital growth, averaging 7.4% per annum over 2024-2028.

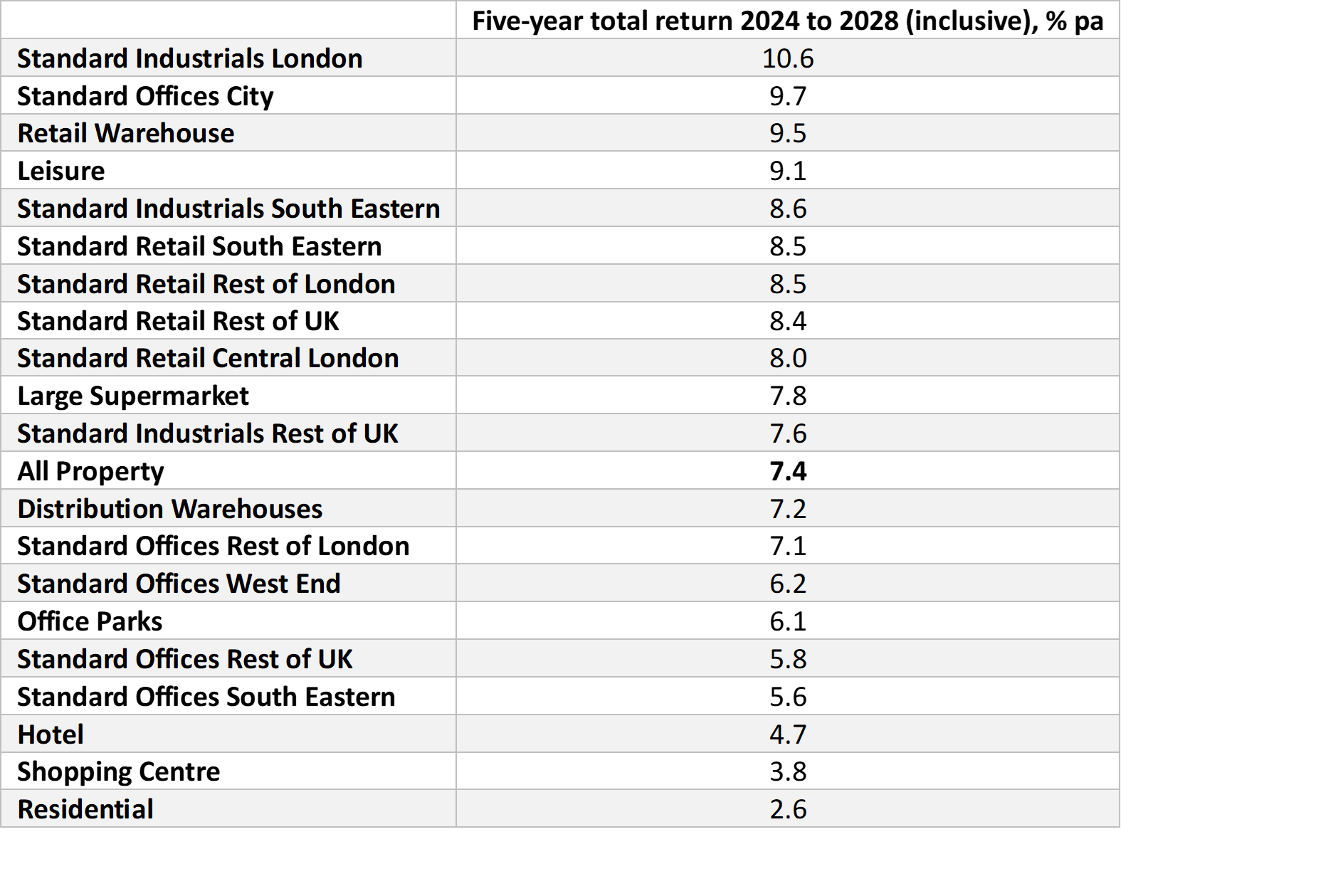

Top Performers (Five-year total return 2024 to 2028):

* London standard industrials remain at the top of the rankings ahead of retail warehouses and City offices.

* Other industrial regions rise in the rankings as rental growth is stronger than previously expected.

* Shopping centres remain at the bottom of the rankings.

Two alternative scenarios that can be tested in the RES Model:

1. Market Revitalisation: Investors could be drawn back to the market by a combination of rising property yields, falling gilt yields, and expectations of an improving economy – favouring Central London and shopping centres.

2. Continued Decline: The market may experience further price drops due to an increase in non-performing loans or distressed borrowers – impacting the office sector most adversely.

Which scenario would you put a higher probability on and have we got the sector impacts correct?

For further information on the RES Forecasting Service, please email contact@realestatestrategies.co.uk