Thoughts on risk number 8: is yield an indicator of risk?

Assuming that the market is efficiently priced, pricing adjusts to equalise risk-adjusted expected returns. Higher risk therefore equates to higher yields to compensate for this risk. However, yields also adjust for differentials in expected growth, vacancies and costs.

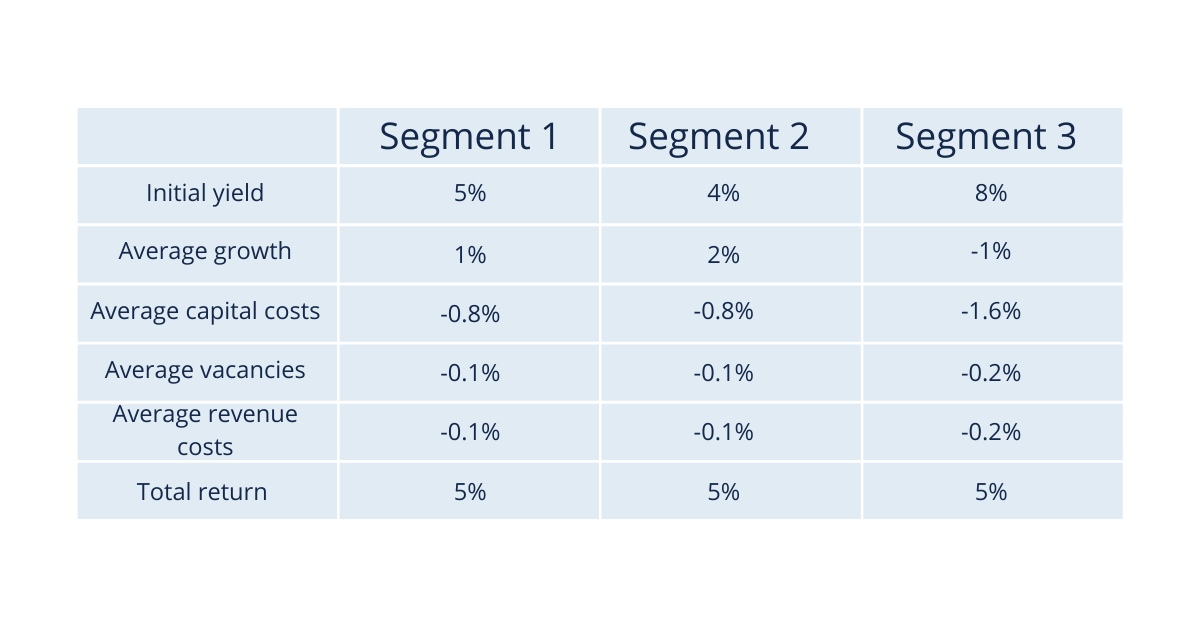

To illustrate, let’s assume that three segments have equal market risk, but that the expected average growth, capital costs, vacancies and irrecoverable costs vary between the segments. Assuming a required return of 5%, then the pricing across the three segments adjusts so that each segment is expected to deliver a 5% return.

The difference in the yield between the segments is therefore not a function of different risk levels; the lower yield on segment 2 for example, does not indicate lower risk, nor does the higher yield on segment 3 indicate higher risk.

In this illustration, as often in practice, the yield differential is associated predominantly with higher and lower growth expectations and to a lesser extent higher or lower costs and vacancies.